Swiss prosecutors have uncovered a previously undisclosed offshore company that was used by Sergei Roldugin, a cellist known as “Putin’s purse,” to funnel at least $300 million. The company was involved in various activities including the construction of the Moscow-St. Petersburg toll highway and the controversial logging of the Khimki Forest. For the first time, the court acknowledged that Roldugin acted on behalf of beneficiaries rather than in his own interests. While the prosecutors did not identify the actual beneficiary, they strongly suggested that it was Putin.

The world was first made aware of Sergei Roldugin, one of Putin's “wallets,” who was believed to be a beneficiary of multiple offshore companies receiving funds of questionable origin from Russia, through the investigation of data from the “Panama archive,” which contained a vast collection of documents leaked from the offshore law firm Mossack Fonseca. Until now, this knowledge has been solely based on leaked documents.

Four managers of Swiss Gazprombank recently faced legal action in Switzerland, with charges against Roldugin being confirmed by official documents from the Swiss prosecutor's office. The managers were accused of lacking due diligence when making transactions and were subsequently found guilty and handed various fines. Alongside several previously identified offshore companies, the case also mentioned Rogus International Investments Ltd., a company linked to Roldugin. Through a series of subsidiaries, it was discovered that Rogus International Investments Ltd. was involved in the construction of the controversial highway through the Khimki Forest near Moscow. This revelation suggests that both Arkady Rotenberg and Roldugin could have received funds from the government and banks for the highway's construction.

In 2014, four firms established accounts with Swiss Gazprombank, including Panamanian International Media Overseas SA and its Cypriot subsidiary Med Media Network Ltd, as well as Cypriot companies Namiral Trading Ltd and Norma Group Ltd, registered in the British Virgin Islands. The bank was aware that Sergei Roldugin, the godfather of Putin's daughter, was the beneficiary of the first two companies, and Oleg Gordin had the authority to sign on these accounts. A few years later, Gordin's name appeared in investigations related to offshore documents from the Panama Papers leak. However, it was already well known that Roldugin and Putin shared a close relationship at the time when these bank accounts were established, as evidenced in a biographical book about the Russian president, From the First Person.

The third firm was at that time owned by the company Norma Group, and subsequently by another St. Petersburg businessman mentioned in the Panama Papers, Alexander Plekhov.

According to the prosecutor who signed the indictment, Jan Hoffmann, the management of Swiss Gazprombank should have been alerted by Sergei Roldugin's lifestyle, profession, and biography at the time. It seemed unlikely that he had earned such substantial profits, and this should have been a “wake-up call” for the bank's management. Cypriot accounting records show that Med Media Network reported a profit of 534 million rubles ($6,829,860) in 2014, 458 million rubles ($5,857,820) in 2015, and 1.1 billion rubles ($14,069,000) in 2016. The majority of the company's income came from dividends paid by CJSC Video International. Video International, known as Vi on the market, had been the leading seller of TV advertising in the Russian market since the 1990s and was eventually shut down in 2020. Its net profit was more than 3 billion rubles ($38,370,000 ) in 2015.

The substantial amount of money that flowed into Roldugin's accounts from Russia did not raise any red flags for the Swiss bank, and all they had in the Know Your Client folder was a printout from the Mariinsky Theater website. However, it is unlikely that Gazprombank did not know how to Google, given that International Media Overseas already had an account at Swiss Gazprombank. The Know Your Client folder contained printouts of an article in Kommersant that stated that Roldugin was a member of Putin's inner circle and the godfather of the president's daughter. In addition, the accounts were opened with the assistance of Bank Rossiya, which serves a limited group of individuals closely linked to the top echelons of the Russian government, yet the employees of Swiss Gazprombank failed to see the potential issues with this arrangement. By the end of 2015, Gazprombank was fully informed of the situation, as evidenced by the report prepared to determine whether to continue maintaining Roldugin's account. The bankers were aware that the purpose of the International Media Overseas account at the Swiss Gazprombank was for Roldugin to personally withdraw money, yet no one bothered to ask Roldugin about the source of the funds.

The substantial amount of money that flowed into Roldugin's accounts from Russia did not raise any red flags for the Swiss bank

Namiral Trading, a company based in Cyprus, also held shares in Vi. According to the disclosed information, Namiral Trading joined the capital of Vi in 2012. In 2013, the company had 7.5 billion rubles ($95,962,500) in receivables, 8.6 billion rubles ($110,354,082) in payables, and paid 277 million rubles ($3,554,428) in dividends to the beneficial owners for the year. The structure of the balance sheet suggests that Namiral Trading was used as a “pipeline” to funnel money. Based on its financial statements, it is estimated that at least $200 million was funneled through Namiral Trading in this way.

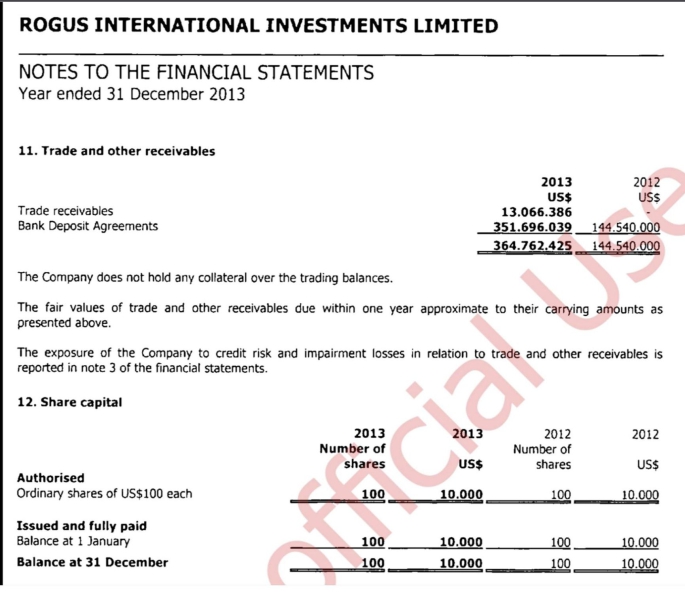

The prosecutor in Zurich discovered another “pipeline” after examining the contracts of Namiral Trading and Med Media Network. This pipeline involved a Panama-Cypriot company called Rogus International Investments Ltd. In the summer of 2014, Roldugin's and Plekhov's offshore companies gave interest-free loans of 350 million rubles ($4,481,750) each for a duration of ten years. However, the purpose of the money transfer was not specified. At the time, the owner of the company was an entity in British Virgin Islands, known for being one of the most opaque jurisdictions for business dealings. Prior to that, the owner was Alexander Plekhov (from 2009-2012) and Sergey Roldugin (from 2007-2009).

That is, the businessman, who has a successful medical business in St. Petersburg and whose friend is Yuri Kovalchuk, the owner of Bank Rossiya, and the musician from the Mariinsky Theater were simply transferring money from one company under their control to another.

Based on its accounts payable and receivable, Rogus International Investments was utilized to channel over $300 million throughout its entire existence.

There is limited information available about Rogus International Investments, but we have obtained court documents related to a complaint against the French company Vinci, one of the beneficiaries of the construction of the highway through the Khimki Forest. The complaint was filed by activists and the Bankwatch Network who discovered that Rogus International Investments, through a chain of companies, held a 15% ownership stake in Vinci Concessions Russie – a division of Vinci – which was involved in the construction of the highway through the Khimki Forest. The remaining ownership stake was allegedly held by another of Putin's acquaintances, Arkady Rotenberg, and offshore companies. The activists believed that the construction of the highway was illegal and that funds were being embezzled and transferred abroad. In 2013, the activists, including Yevgenia Chirikova, filed a complaint with the prosecutor's office in Nanterre, France. However, the case stalled as the Russian side was supposed to be questioned next, according to Chirikova.

“Our complaint was accepted, which is a serious matter as not all complaints are accepted in France. Subsequently, I was called in for questioning, and the prosecutor stated that they needed to verify the information regarding the violations with the Russian siloviki and the Ministry of Transport. I responded, 'Do you understand that you're essentially asking the mafia if they're to blame?' The response I received was that it was simply standard procedure.”

As a result, no state investigation was ever conducted into Vinci's activities in Russia and the offshore companies behind it.

Northwest Concession Company LLC, which is a subsidiary of Vinci Concessions Russie, is the builder and operator of the highway. This company earns an annual net profit of over a billion rubles and pays out several hundred million rubles in dividends per year. The dividends are received by Rogus International Investments, which is controlled by Plekhov and Roldugin.

Thus, it has been revealed that Sergei Roldugin was also involved in the construction of the highway through the Khimki Forest, in addition to Arkady Rotenberg, as was previously known. However, according to the Swiss prosecutor's office, Roldugin and his offshore partner Alexander Plekhov were considered “nominees,” meaning they were acting on behalf of someone else.

In some cases, people prefer to conceal their ownership or management of a company, and thus avoid legal responsibility if the company is scrutinized by regulatory authorities. This is particularly true if the company is involved in tax evasion, as the director and accountant are typically held accountable. To achieve anonymity, people often hire “nominees” or “nominal directors,” who are paid a fee to register the company under their own name. These individuals have no real connection to the company and may serve as directors for several dozen or even hundreds of companies. Although the use of nominee directors may be illegal in some countries, in practice they are rarely prosecuted for posing as the actual owners or managers of a company.

The concept of a nominee beneficiary is less common, as such an individual receives dividends from the company. This requires a high level of trust between the real beneficiary and the nominee, as the nominee must not take all the company's money for themselves.

The Swiss prosecutor's indictment implies that Roldugin and Alexander Plekhov are not the true beneficiaries of the Cypriot companies that received funds from Vi, but rather acted on behalf of others. Essentially, the prosecutors claim that they were named as nominal beneficiaries, and the real beneficiary remains unidentified, although they strongly suggest that it may be Putin himself. This is significant because it marks the first time since the publication of the Panama Papers a court has acknowledged that Roldugin did not act solely in his own interest.

For the first time since the publication of the Panama Papers a court has acknowledged that Roldugin did not act solely in his own interest

It was only in April 2016, after being prompted by the Swiss Financial Supervisory Authority (FinMA), that the bankers requested explanations from Roldugin. However, they received no response and, by September of that year, Roldugin's accounts had been closed. The Zurich prosecutor's office believes that the bankers were aware of the need to seek an explanation from Roldugin since at least late 2015.

The OCCRP investigation revealed that the money from Roldugin's offshore accounts was used for various purposes. For instance, the funds were used to pay for the land under Igora, the ski resort where Putin's daughter got married, the yacht club on the shores of Ladoga, and the Gustav Winter dacha on Ladoga, which is believed to be one of Putin's luxurious estates.

The trial's importance lies in the fact that Switzerland may no longer serve as a safe haven for Putin's cronies and oligarchs. This marks the first instance in which a journalistic inquiry into Russian illicit funds was pursued by the prosecutor's office and resulted in a conviction.